Group Health Insurance in Singapore

Singapore company group health insurance would let people reside in the country through their company. Almost all international companies allow their employees to work in Singapore, even if they are working for a company outside the island nation.

Many expatriates think that company group health insurance in Singapore is expensive because usually the company charges each expat partner 28% of their salary for this type of cover. This figure is considered high but isn’t compared to other countries’ average salaries. The difference between company group health insurance cost and individual policy’s price becomes bigger when the employer’s contribution is included.

Most local companies provide company group health insurance partner coverage for free or very cheap prices. However, it often depends on your company size and company’s policy.

Generally, the company reimburses its employees and their family group health insurance premiums in the case of medical emergencies only – company group health insurance in Singapore cost doesn’t cover anything else, such as dental treatments or optical examinations. If a company provides additional private medical coverage (PMC) at a cheap rate for employees and their families, the company also pays to the company group health insurance premiums (rather than the employee himself/herself).

Employees should shop around for the best company group health insurance provider because usually, the company does not offer many proposals. You can ask your employer, friends, and other expatriates who already have company-provided cover about their experience and to recommend company group health insurance providers. One more step you can take in the company group health insurance Singapore search is to ask the company HR representative about the company’s plan. In addition, the company may have some company group health insurance requirements (e.g., you can’t avoid maternity insurance if your partner is pregnant).

Please note the following important company group health insurance points:

– You will be required to undergo a medical checkup for the company’s job offer approval;

– If you are not a Singaporean citizen but hold permanent residency status of Singapore, you must apply for an appropriate long term visa before arrival in the country;

– Also, please note that all family members listed on your company group health insurance will need their own visitors’ visas, or employment passes issued by the appropriate authority to stay in the country. However, having company group health insurance does not guarantee complete support for your medical expenses. The company usually offers limited company group health insurance coverage (e.g., dental care is excluded).

You can take up the company’s private medical cover, which is cheaper than the individual policy.

Your company should help you find a company group health insurance provider just if the company doesn’t provide a company group health insurance plan. However, company policy changes every year and depends on the company’s financial status – it is better to contact your employer personally about the company’s company group health insurance requirements. You can also ask for advice from other expatriates working for the same company as you do or consult with friends living outside Singapore who have already purchased this type of cover.

When choosing company group health insurance, make sure that all family members are covered by doctors’ appointments, medical tests, etc., because usually private medical coverage excludes them (especially children). Also, note that if one of the family members has an existing serious illness, then the company may not accept company group health insurance with that person included in the company group health insurance plan because the company doesn’t want to be responsible for high medical expenses. In this case, the company usually offers company group health insurance without that person included (but without any discount).

5 Tips to Excel in Online Learning Environments

5 Tips to Excel in Online Learning Environments  Top 10 Careers in Data Science

Top 10 Careers in Data Science  Tutor John W From DoMyEssay Shares A Brief Guide On How To Write Fiction

Tutor John W From DoMyEssay Shares A Brief Guide On How To Write Fiction  8 Best Homework Apps for College in 2022

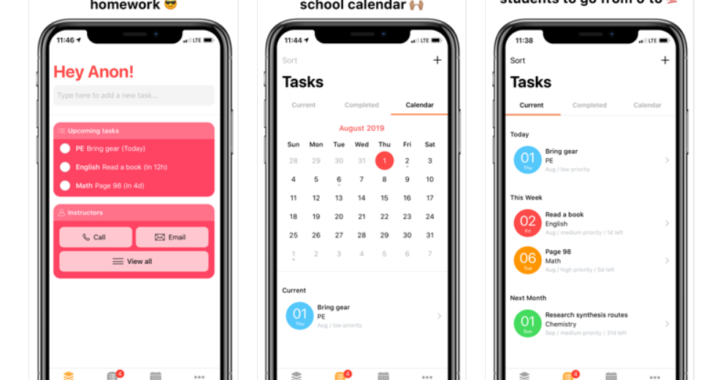

8 Best Homework Apps for College in 2022  5 Tips to Improve Your Instagram Engagement Rate

5 Tips to Improve Your Instagram Engagement Rate